On this page:

Project Concept

Housing

Action Plan Bullets

1

ESTABLISH EMPLOYER ASSISTED HOUSING TASK FORCE

2

CREATE BETTER AWARENESS AROUND AVAILABLE TOOLS AND RESOURCES

3

CREATE THE EMPLOYER ASSISTED HOUSING FUND

4

DETERMINE FEASIBILITY OF TAX ABATEMENT PROGRAM

5

IDENTIFY DEVELOPABLE LAND

6

SOLICIT PROPOSALS FOR MULTIFAMILY BUILDER

7

SOLICIT PROPOSALS FROM HOMEBUILDERS

Concept

Housing

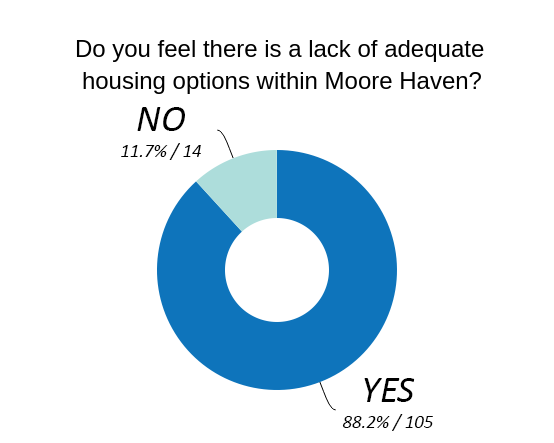

The primary challenge faced by Moore Haven is similar to most rural communities: the cost to build or renovate does not equal what a seller should receive for the finished product. For example, a builder must price a new home at $160,000 in order to cover their costs and earn an acceptable profit. But the local buyers will only pay $145,000. Similarly, homeowners looking to renovate their homes face the challenge of recouping their investment should they need to sell their property in the next few years. These challenges create a disincentive for investment by the builder or homeowner.

To determine development solutions to support new and renovated housing development, Alchemy reviewed and leveraged existing reports, conducted an employee housing needs survey with major employers, and engaged in interviews with builders and contractors to determine some of the major challenges facing Moore Haven. A development analysis was completed to highlight potential sites for redevelopment and new development areas in and around the community. The housing action plan includes recommendations for how best to use existing development tools and create new incentives to achieve Moore Haven’s goal of growing its housing stock.

Housing

Challenges

Barriers to Developers/Investors

When people think of rural living, they think affordability. But the cost of building materials and trades needed to construct a home are much the same in rural as it is in urban. However, urban markets can typically build more units at any given time lowering the overall cost of construction and increasing the return on investment to the builder. Urban markets can also command a higher sale price due to their proximity to employment centers and other amenities.

For Moore Haven the cost of land is a major contributor to this challenge. While there are hundreds of undeveloped lots in Glades County, many parcels require additional investment to build out the necessary infrastructure to accommodate a new home. On the other hand, a neighboring community such as Labelle has an abundance of shovel-ready parcels still available as a result of the 2008 housing crisis. These costs add up making it more expensive to do business in Moore Haven.

Buyers’ financing challenges

Stakeholder feedback and statistical analysis have identified a low median household income as a top challenge Moore Haven homebuyers face when purchasing a house. Main contributors to this challenge are insufficient resources for a down payment and becoming cost-burdened (e.g. paying for a mortgage payment that require more than 30% of one’s monthly income). These income challenges prove to be a high hurdle for some residents to transition from rental units to owner-occupied housing.

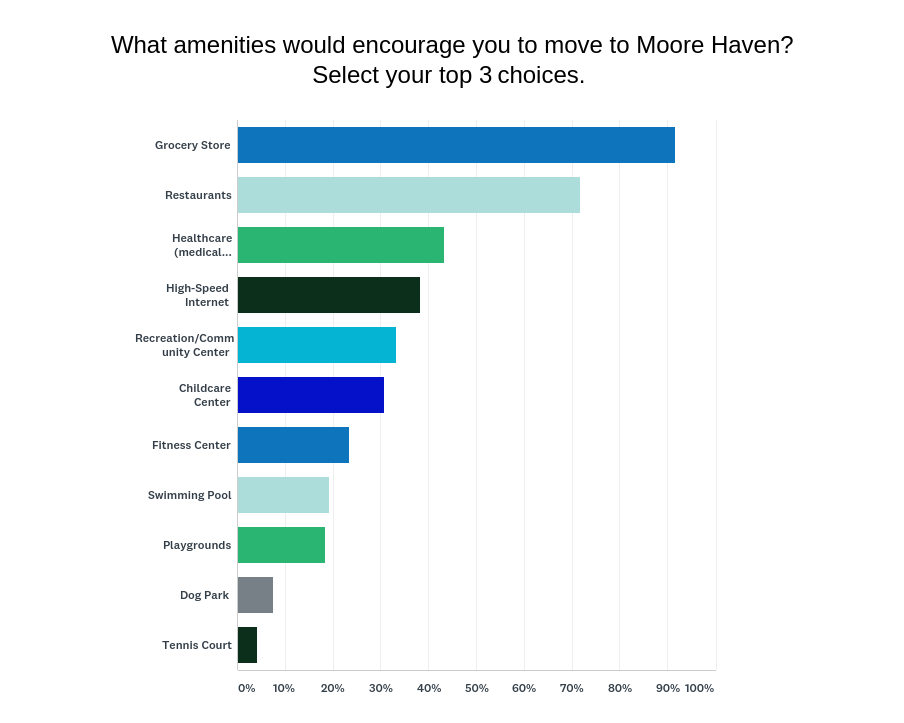

Lack of retail and services

Many stakeholders identified a lack of retail and services as a barrier to living in town. The employee housing needs survey identified a grocery store, restaurants, and healthcare providers as the top three amenities needed to make Moore Haven more appealing to new residents. While the creation of amenities is outside the scope of housing incentives, this action plan addresses the top two needs, a grocery store and a restaurant, through achievable business plans found in their respective priority project sections of this website.

Existing

Tools & Resources

State & Federal Programs

There are existing state and federal resources that are available to help finance new or renovate existing homes. One of the best resources is the Florida Housing Finance Corporation who provide resources that meet the needs of low-to-moderate income households as well as those at or right above the median household incomes.

For instance, the Preferred Conventional Loan program allows households of two or less people an income up to $71,875 and households of three or more up to $75,000. If we take these gross annual incomes times 2.5 – a general rule of thumb to estimate how much home you can afford – households of two or less people could afford up to $179,000 and households of three or more up to $187,500. These figures are well in line with many of the housing options being constructed in and around Moore Haven.

For more a more expanded list of these programs, click here to download the Funding Resource Guide in

Appendix C

Development

Strategy

Employer Assisted Housing

Employer-assisted housing (EAH) programs help close the homeownership and rental affordability gap and allow workers to live in the communities where they are employed. This has the impact of reducing employee absentees and long-term turnover of staff. EAH programs can be described as any employer sponsored housing benefit, which could include, but not limited to, down payment assistance or rental assistance, home buyer education and counseling, or low-interest mortgages. It’s also common for the local government and non-profit agencies to contribute to EAH programs.

In many cases, EAH programs access state and federal funding to help support their efforts. However, these programs are typically limited to low to moderate income households. The challenge for many Moore Haven employers, including the schools and correctional facility, is that a majority of their employees make incomes above the eligibility threshold. For example, the recently complete affordable rental housing in Moore Haven has an income threshold of ~$35,000 while many of the starting wages are at or just above this figure.

Compounding this issue is the previously mentioned cost gap (see Housing Challenge #1) and how that impacts the appraisal gap – i.e. financing for new homes in the area does not match the cost or return on investment for the builder. For example, a new home is for sale at $160,000 but a bank will only finance up to $145,000 due to a lack of comparable properties recently sold in the area. The borrower would have to renegotiate the sale price down with the seller to align with the financing or provide the additional $15,000 to meet the gap. And it is for this reason many builders have decided to build elsewhere and avoid this issue.

The first step to creating an employer-assisted housing program is to identify which employers and local partners are willing to support the initiative and what assets they can bring to the table. The EAH program then needs to determine how it wants to deploy these resources: help their employees obtain existing housing or help increase the supply of affordable housing in the community. See the list below for examples of each option.

Increasing the Community’s Supply of Affordable Housing

- Cash Contributions to Housing Projects

- Donation of Land

- Housing Developed and Owned by the Employer

- Construction Financing

- Low Income Housing Tax Credit Investment

Helping Employees Obtain Affordable Housing

- Down payment/Closing Cost Assistance

- Secondary (Gap) Financing

- Rent Subsidies

- Homebuyer Education and Counseling

- Help with Applications, Credit, Moving Costs, Deposits, and/or Possible Rent Guarantee or Sublease

For more details on Employer-Assisted Housing programs, see the EAH Resource Guide in

Appendix D

Recommended Applications of EAH

Multifamily Complex

Rental housing provides an entry point into the housing market for many new employees, especially those that are single and in the 18 to 34 age range. But currently there are few options for quality, affordable rental units available in Moore Haven. The EAH program could approach this challenge in two ways: (1) build its own rental units exclusively for employees of EAH program participants or (2) provide rent subsidies to afford rental units.

Of the two options, it would make sense for the EAH program to provide incentives to a private developer while guaranteeing tenants to reduce risk of vacant units. If a unit comes available and sits vacant for more than 90 days, the EAH program will begin to pay for a portion of that rent or allow non-employees the ability to lease the space. The EAH program may also need to provide a monthly rental subsidy of $100 to $200 to help keep the lease rates affordable and cover the builder’s costs. These arrangements would be worked out upfront in a legal agreement between the EAH program and the builder.

Infill Lots

Infill development can bring several benefits:

- Municipalities can save money by promoting development in areas that already have infrastructure connected to public services, as opposed to financing new infrastructure in undeveloped greenfield sites.

- Infill development can raise taxable value of an undeveloped property and increase market values in the surrounding neighborhood.

- It can bring residences and destinations closer together, making it easier for people to walk, bike, or drive shorter distances, which reduces pollution from vehicles.

- For distressed communities especially, infill development can help stabilize a community by attracting a greater diversity of household income levels, bringing new resources to a neighborhood and reducing concentrated poverty.

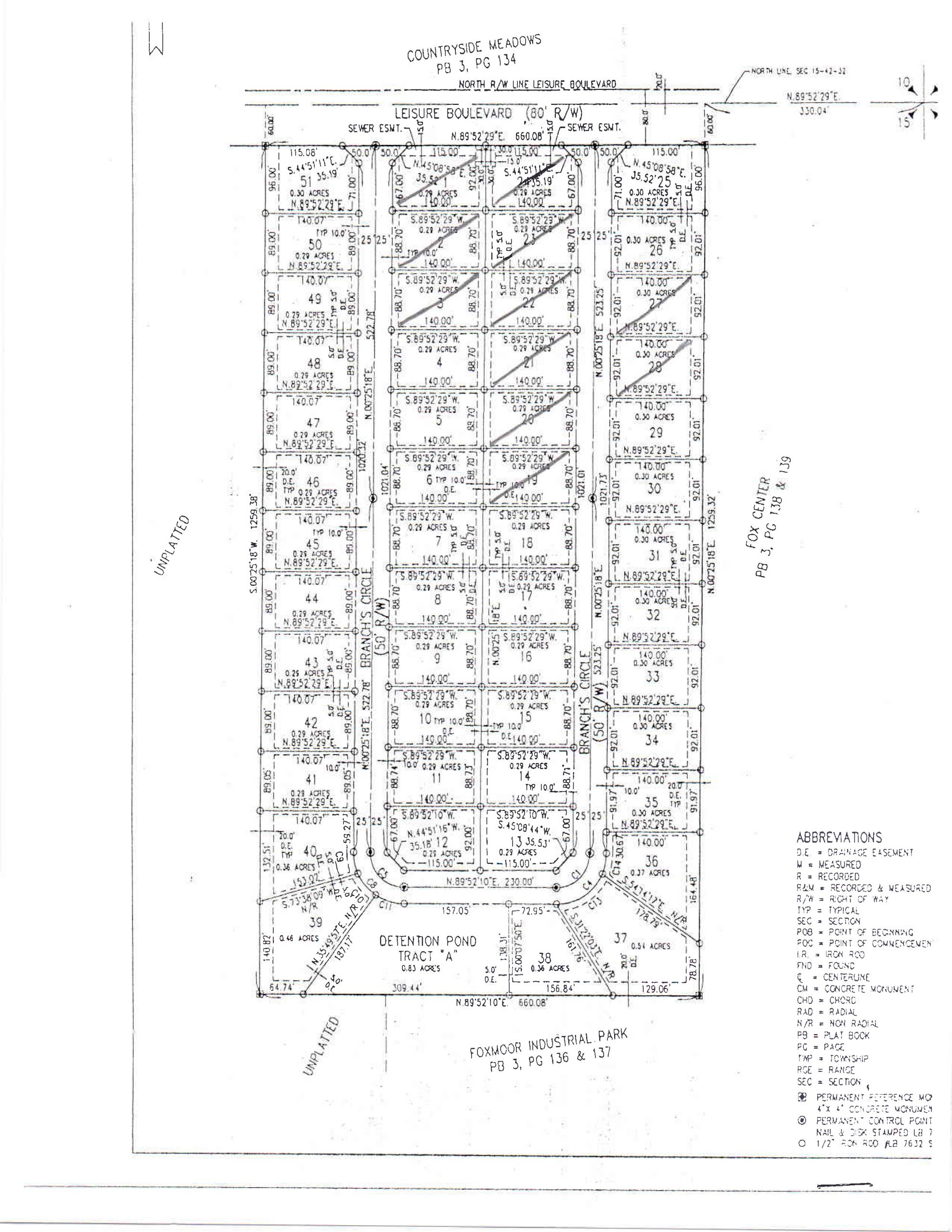

In order to better understand the potential for development in and around Moore Haven, a housing development assessment was completed. This process included reviewing parcel data for vacant lots and undervalued properties as designated by the Glades County Assessor. The findings of this analysis can be used to help direct development throughout the community from individual infill lots to new subdivisions with multiple housing units.

Using the interactive development analysis map below, it is apparent there are a number of infill and undeveloped lots available in and around Moore Haven. An EAH program could purchase those lots and then provide those lots to employees who can then build on the site with a preferred builder. Removing the cost of a residential lot can reduce the cost of building a house by 10-20% which helps to make the financing more affordable. For this program to work, five homes should be the minimal target to attract a single builder and create enough scale to attract the necessary trades and contractors to the community. Local banks could also waive certain fees or provide special financing to help further reduce overall costs of the future homeowner’s mortgage.

This program may only need to be in operation for a few years to help establish higher appraisal values and correct the financing gap to cover the fair market value of a for-sale property in Moore Haven.

Moore Haven

Lot Analysis

Housing

Action Steps

1

ESTABLISH EMPLOYER ASSISTED HOUSING TASK FORCE

LEADERS: Mayor Bret Whidden, Mike Pressley, John Ahern, and Dr. Beth Barfield

WHO: City of Moore Haven, Glades County, Glades County EDC, Glades Electric Cooperatives, Glades County School District, other major employers, First Bank and other financial institutions

HOW: Convene meeting to setup structure of the task force and outline responsibilities. Some of the first items to address include (1) identify fiscal agent, (2) determine what assets members can provide, and (3) how they will be deployed. For more details on Employer-Assisted Housing programs, see the EAH Resource Guide in Appendix D.

WHEN: Q2 2021

2

CREATE BETTER AWARENESS AROUND AVAILABLE TOOLS AND RESOURCES

LEADERS: Andrew Couse and John Ahern

WHO: EAH Task Force, City of Moore Haven, Glades County, Glades Electric Cooperatives, First Bank and other financial institutions

HOW: Connect with local housing service providers to help connect potential homebuyers with their available services such as special financing options and individual home counseling. Banks and other financial institutions will also play a role in educating themselves on the available programs outlined in the Funding Resource Guide (Appendix C) and how they can be offered locally.

WHEN: Q2 2021

3

CREATE THE EMPLOYER ASSISTED HOUSING FUND

LEADERS: Andrew Couse, Mike Pressley and John Ahern

WHO: EAH Task Force, City of Moore Haven, Glades County, Glades County EDC, Glades Electric Cooperatives, other major employers, First Bank and other financial institutions

HOW: Once assets are accounted for – i.e. pledged funds, parcels available for development, etc. – the task force should request a meeting with Cynthia Ricker, SHIP Administrator for Glades County, as well as representatives from the Florida Housing Finance Corporation, USDA Rural Development and other major housing service providers to determine how best to maximize these local funds with state and federal resources.

WHEN: Q2 2021 – Q3 2021

4

DETERMINE FEASIBILITY OF TAX ABATEMENT PROGRAM

LEADERS: Mayor Bret Whidden, Mike Pressley and John Ahern

WHO: EAH Task Force, City of Moore Haven, Glades County, Glades County School District

HOW: Residential tax abatement could be a great tool to help differentiate yourself from neighboring communities and attract new residents to Moore Haven. All major taxing authorities – city, county, school district, etc. – would need to be involved in this decision along with a public referendum. The tax abatement program could be very aggressive at 100% for up to 10 years or it could be applied in a stair-step method with greater tax savings up front and lower over a period of 7 to 10 years – such as 100% year 1 – 3; 75% year 4- 6; 50% year 6 -10. Restrictions on this incentive could be enacted through a minimum number of new units (i.e. 6 or more housing units constructed in 12-month period).

NOTE: When applying incentives, tax abatement and tax increment financing (TIF) are typically applied exclusive of one another to avoid completely depleting the public coffers.

WHEN: Q2 2021 – Q3 2021

5

IDENTIFY DEVELOPABLE LAND

LEADERS: Mayor Bret Whidden, Mike Pressley, and John Ahern

WHO: EAH Task Force, City of Moore Haven, Glades County, Glades County EDC, Glades Electric Cooperatives, Glades County School District, other major employers, First Bank and other financial institutions

HOW: The purpose of this step is to determine if there is a tract of land that could be purchased for a discounted rate or donated from a private landowner or one of the task force partners. The site would be used for constructing the multifamily project and/or parcel out for single family lots. Use the lot analysis interactive mapping tool to help identify potential sites.

WHEN: Q3 2021 – Q4 2021

6

SOLICIT PROPOSALS FOR MULTIFAMILY BUILDER

LEADERS: Mayor Bret Whiddenm, Mike Pressley, and John Ahern

WHO: EAH Task Force, City of Moore Haven, Glades County, Glades County EDC, Glades Electric Cooperatives, other major employers, First Bank and other financial institutions

HOW: A similar process should be followed for the multifamily project as the single-family builder. These rental units could be duplex/triplex style or a larger multi-unit structure, however, the scale and design should be appropriate with the chosen site and the surrounding properties. The EAH program would then help match interested employees with these rental units and the level of monthly subsidy needed to meet their rent.

WHEN: Q4 2021 – Q1 2022

7

SOLICIT PROPOSALS FROM HOMEBUILDERS

LEADERS: Mayor Bret Whidden, Mike Pressley, and John Ahern

WHO: EAH Task Force, City of Moore Haven, Glades County, Glades County EDC, Glades Electric Cooperatives, other major employers, First Bank and other financial institutions

HOW: The task force should establish a set list of requirements including, but not limited to, construction materials, house style, and price points for a builder to construct the first round of homes. A minimum of 5 homes should be targeted for construction in the first round. The EAH program would then help match interested employees with the available lots and work with the builder to finalize the design of their home.

WHEN: Q2 2022 – Q3 2022