On this page:

Project Concept

The “Ketch” Restaurant

Action Plan Bullets

1

RECRUIT OWNER/OPERATOR

2

NEGOTIATE LEASE AND/OR PURCHASE PRICE OF LAND

3

FINALIZE/REVISE BUSINESS PLAN

4

FINALIZE BUILDOUT CONCEPT

5

SECURE CAPITAL TO COMPLETE BUILDOUT

6

DEVELOP MARKETING STRATEGY, HIRE STAFF, AND OPEN FOR BUSINESS

Restaurant Concept

The Ketch Drinkery & Grill

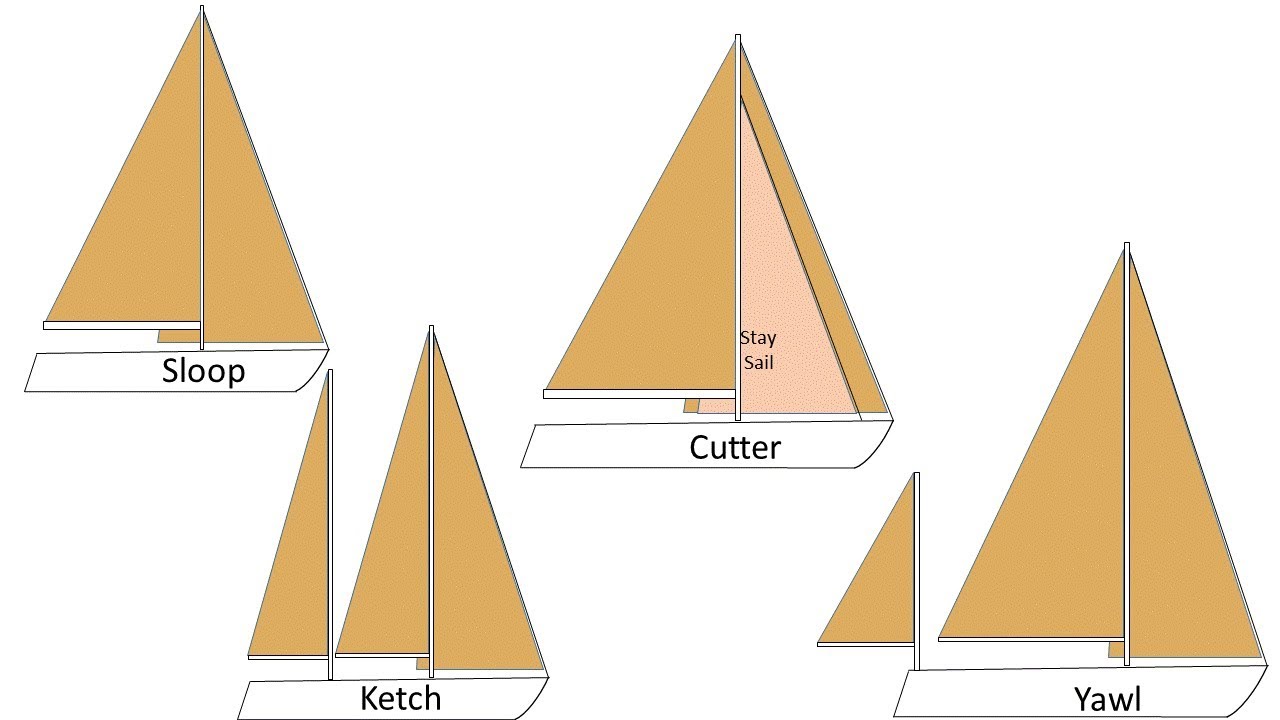

The term “ketch” is refers to a two-masted sail boat but when spoken it sounds like “catch” as in a fisherman’s catch. The name is approachable enough to be embraced by locals and engaging enough to capture the imaginations of recreational, seasonal and lifestyle boaters who will likely recognize the sailing reference. In the end, the name simply has to peak enough interest to entice visitors to dock, drink and dine.

A mockup of what the Ketch logo could look like is seen at right. For clarity, consider showing images of a ketch sailboat, whether in the official logo or inside the restaurant.

Restaurant

Location

The Ketch Drinkery & Grill location at the marina will have maximum location advantage as the first and last riverside stop by the locks between the Caloosahtchee River and Lake Okeechobee. The Ketch has the opportunity to provide refreshment and respite to travelers willing to dock, a carry-out option for those who want to grab something prepared, or a full afternoon or evening to drink and dine by the river experience. Executed thoughtfully, The Ketch Drinkery & Grill can fulfill at least a portion of the expressed desire by locals for a better eating experience within the community, as well as attract travelers and other patrons from around the area.

However, The Ketch operator will need to focus as much on ambiance and activity as on its food and drink menu. To sustain itself, The Ketch Drinkery & Grill will need to establish itself as a regular “go-to” spot for residents on a weekly or biweekly basis. This can be done with local live music, drink specials, eating events (e.g. seafood boil or steak night), traditional outdoor games like corn hole, giant jenga, and bocce ball. The Ketch will need to leverage a “stay and play” strategy, as a bar and grill where families will feel comfortable hanging out at least a portion of the time.

Restaurant

Layout

The Ketch Drinkery & Grill will first and foremost be a “drinkery.” In short, a riverside bar with a relaxed environment capitalizing on the ambiance of a warm indoor/outdoor setting year-round. The initial build-out will be 2,500 square feet with seating for approximately 100 people. The physical bar will be in a permanently covered portion of the building and include bar seating for up to 15 people. The building will include sliding glass doors that open on the river-facing side of the building. Tables will be under the permanent roof, as well as cascading across a patio toward the water. The tables closest to the bar will be four-person high top bar tables so not block the view of the water (appx 28 seats). Another 50-60 seats will be available in low four tops with optional umbrellas.

Inspiration Images

“he following images were selected to highlight features we’d like to see in the design of the Ketch Drinkery and Grill restaurant space including a Cape Cod aesthetic with wraparound decks and outdoor covered seating.

Source: Riverhouse Waterfront Restaurant in Palmetto, FL

Source: Historic Penninsula Inn in Gulfport, FL

Source: Waterfront Restaurant in Cape Cod, MA

Source: Wellfleet Bookstore & Restaurant in Wellfleet, MA

Source: Charleston Harbor Fish House in Mount Pleasant, SC

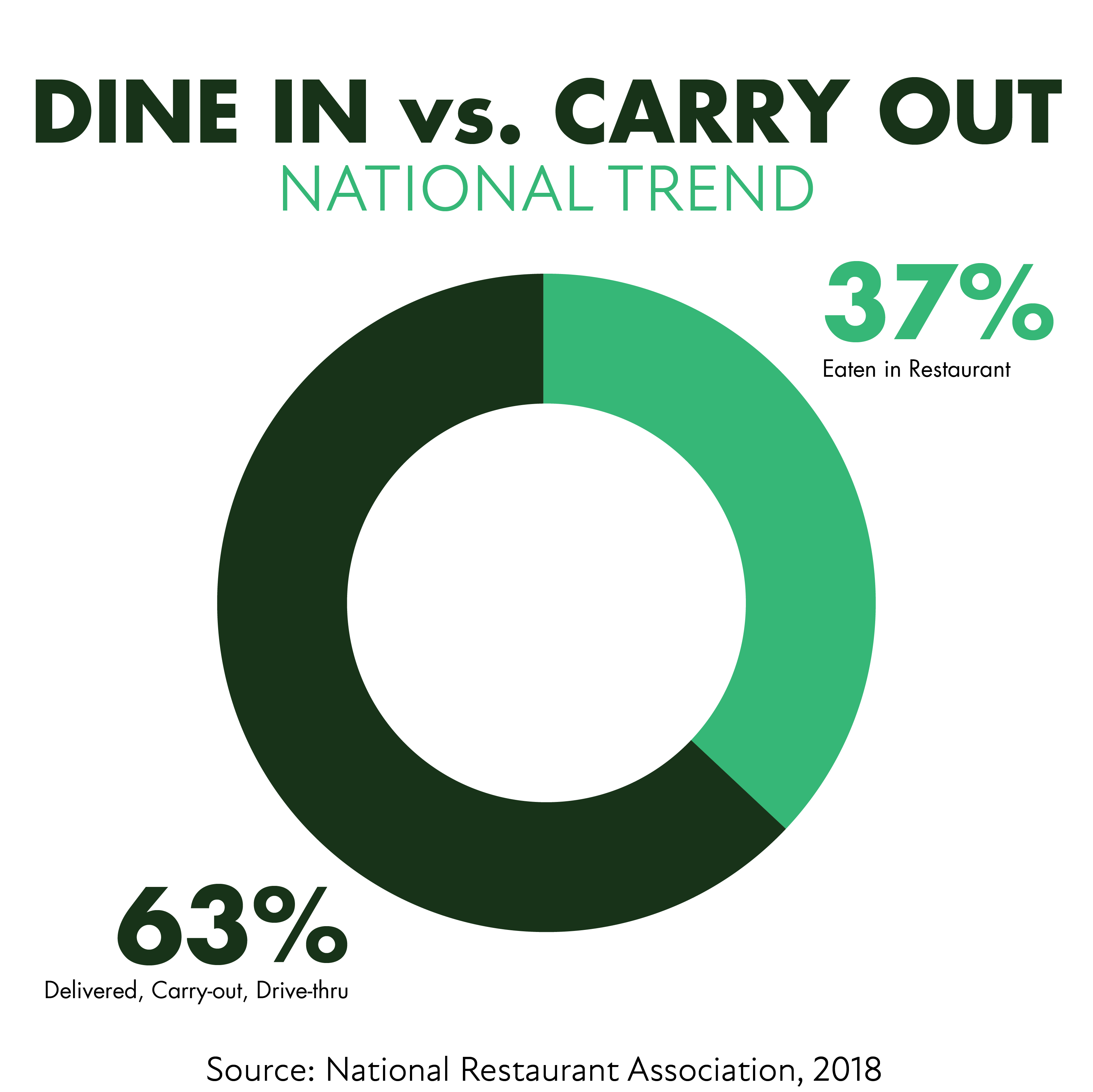

A fast, simple way to order and pick up food for carry-out will be essential. TODAY, ONLY 37% OF RESTAURANT FOOD PREPARED IN A RESTAURANT IS EATEN IN A RESTAURANT. 63% IS DELIVERED, CARRIED-OUT OR PURCHASED THROUGH A DRIVE THROUGH. The Ketch can take advantage of these trends, particularly with a brick oven pizza. That being said, patrons ordering food for carry-out should have to walk into the main bar to pick up their food (versus a separate outward facing window). Having patrons see what’s happening will be one of the best marketing tools to invite them in on a return trip.

The menu will emphasize quality food providing elevated approaches to well understood dishes. All menu items will give a nod to The Ketch’s drink offerings, as the sale of alcohol is more important to the bottom line. The full-flavored gastropub style dishes could include:

- Gourmet Burgers / BYOB – Build Your Own Burger

- Upscale Tacos

- “Ketch of the Day” shrimp or fish special

- Brick Oven Flatbreads/Pizza

- Wraps and Salads

- All-day omelets

Restaurant

Business Model

The business model we have created assumes the following:

- Lunch and Dinner operations: Monday – Thursday

- Stays open until 2 AM Friday and Saturday

- Brunch available Sunday 10 AM to 2 PM, regular menu available thereafter until 10 PM

- Staffing includes 1 FTE GM and 2-3 hourly employees

- Construction of new building is included in the business model

- Startup Costs: $515,000

- Land: $0*

- Building: $325,000

- Equipment: $100,000

- Business Licensing: $5,000

- Alcohol: $6,000

- Liquor License: $65,000**

- Licensing: $5,000

- Food Inventory: $2,000

- Marketing: $5,000

- Staff: $7,000

- Startup Costs: $515,000

*The proposed site is owned by the City of Moore Haven and Glades Electric.

**The liquor license fee of $65,000 is a one-time payment to purchase a liquor license through a licensing broker. Financing is available through the broker; see pg 7 of the business plan for further details

|

Projected Profit & Loss ($450K) |

2021 |

2022 |

2023 |

| Total Revenue | $502,992 | $517,991 | $533,516 |

| Total Expenses | $553,154 | $490,536 | $503,952 |

| Net Profit | ($50,162) | $27,455 | $29,564 |

| Net Profit % | -10.0% | 5.3% | 5.5% |

For a detailed breakdown of the business plan, see Appendix E.

Relevant

Funding Resources

USDA Rural Business Development Grant

This program is designed to aid small, rural businesses with fewer than 50 new workers and less than $1 million in gross revenue. The program has diverse list of uses, but we would apply for up to $350,000 in funds to construct the main building and parking lot for the Ketch.

USDA Rural Economic Development Loan and Grant (REDLG)

The Rural Economic Development Loan and Grant program provides funding for rural projects through local utility organizations such as Glades Electric Cooperative. The program would allow Glades Electric Cooperative to request up to $300,000 to seed the revolving loan in addition to access to low-interest financing up to $1 million. One major benefit of this program is deferred payments up to two years for a start-up venture.

U.S. Small Business Administration Lending (SBA)

The SBA works with lenders to provide loans to small businesses through local lenders like First Bank. The SBA reduces risk for lenders and makes it easier for them to access capital. First Bank provides financing through the 7A Small Loan (5-year term) and 504 Loan (10- to 20-year term).

State Small Business Credit Initiative (SSBCI)

Enterprise Florida’s SSCBCI is another resource to access the SBA 504 Loan program. Typical loan participation is 100% of second mortgage note with a minimum $250,000 loan amount and term between 3 and 18 months.

Restaurant

Action Steps

1

RECRUIT OWNER/OPERATOR

LEADER: Mayor Bret Whidden and Jeff Brewington

WHO: City of Moore Haven, Glades Electric Cooperative

HOW: The most-likely-to-succeed candidate will be a person with a solid business background. Restaurant or bar experience would be helpful, but it is not required. Finding someone local or with a strong connection to the area is another important factor to consider.

WHEN: Q3 2020

2

NEGOTIATE LEASE AND/OR PURCHASE PRICE OF LAND

LEADER: Mayor Bret Whidden and Jeff Brewington

WHO: Owner(s)/Operator(s), City of Moore Haven, Glades Electric Cooperative

HOW: Work with the City and Glades Electric Cooperative, current property owners, to determine a favorable sale agreement or lease arrangement. Should Glades Electric maintain ownership of the building it is recommended that the restaurant owner start with a monthly payment based on the gross lease so he/she has a set amount to pay each month. The rent should be no more than 3% of gross sales or about $1,800 per month. It would make sense for Glades Electric to ask for 5% of gross sales once the restaurant meets a break-even threshold after year three.

WHEN: Q3 2020

3

FINALIZE/REVISE BUSINESS PLAN

LEADER: Owner(s) / Operator

WHO: Owner(s) / Operator, architect, engineers, First Bank

HOW: Begin with business plan included in Appendix E. Refine the plan based on ownership structure, investment options, and estimated construction costs.

WHEN: Q3 2020

4

FINALIZE BUILDOUT CONCEPT

LEADER: Owner(s) / Operator

WHO: Owner(s), operator, architect, engineers, First Bank, Equipment providers

HOW: Address both interior and exterior recommendations as well as cost of kitchen equipment and other high cost items. Consideration will also need to be made regarding the access to the water and future fueling station via water taxi. This accessibility is key to the business model prepared. It is also highly recommended that restaurant equipment companies be consulted as floor plans are drawn. Trimark (kitchen equipment) and Ecolab (sanitation equipment) are suggested service providers.

WHEN: Q3 2020 – Q4 2020

5

SECURE CAPITAL TO COMPLETE BUILDOUT

LEADER: Owner(s) / Operator(s)

WHO: Owner(s)/Operator(s), City of Moore Haven, Glades Electric Cooperative, First Bank

HOW: The City should work with Glades Electric Cooperative, the Owner(s)/Operator(s) and First Bank to determine a financial package that will help reduce the operating costs of the business. This could include seeking local incentives and financial institution to ensure a favorable, low-risk plan. Use of Tax Increment Financing (TIF) is one option to request local support. Tax abatement or a deferment of the city’s property taxes would be another option, although, there would need to be a public referendum to approve the use of this tool. It should also be noted applications for the USDA Rural Business Development Grant are due in December 2020 with awards as early as March 2021.

WHEN: Q4 2020 – Q1 2021

6

DEVELOP MARKETING STRATEGY, HIRE STAFF, AND OPEN FOR BUSINESS

LEADER: Owner(s) / Operator(s)

WHO: Owner(s)/Operator(s)

HOW: Design all marketing materials using preliminary business plan as a starting point. Share photos and videos of construction progress to generate excitement. Hire staff and begin training. Again, refer to preliminary business plan for details. Hold soft opening events. Celebrate with a grand opening, possibly tied into a local event like ChaloNitka.

WHEN: Q1 2021 – Q3 2021